This morning’s New York Times contains an article by Alan Yuhas entitled “Don’t Expect a Quarantine Baby Boom.” Recall an early “Fearless Prediction” of mine to that effect. This phenomenon requires a little more elaboration. And that relates to the nature of the so-called “recovery.”

There is speculation whether the “recovery” from the current situation will look like a “V” or a “U” or even the Nike “swoosh” for a little extra pizazz. All of this alphabet (and logo) talk pertains to GDP—the only metric that many people wish to consider. Sadly, this is to grab the “wrong end of the stick.” It is the wrong end because GDP is a complex mix of many variables that are themselves quite obscure—perhaps unknowable.

Among the considerations that must figure into all of this speculation, consider just a few: (1) the unknown changes in population over the near future; (2) the unknown impact on closures and bankruptcies of millions of businesses; (3) the unknown effect of changes in the labor force (the number of people working or actively looking for work); (4) the unknown labor force participation rate (the share of the work force actually working); (5) the unknown level of prices by which the total physical output of goods and services is actually valued for measurement as GDP; and (6) an unknown return wave of infections that will scramble all of the above.

It is better to start with the several components of a complex factor—only then can we meaningfully approach the aggregate of all of the disparate constituents. To gain traction on this problem, we must start with the realization that the U.S. has been experiencing, over the past decade or so, many symptoms of what I will call “late (or mature) capitalism.” What are these traits?

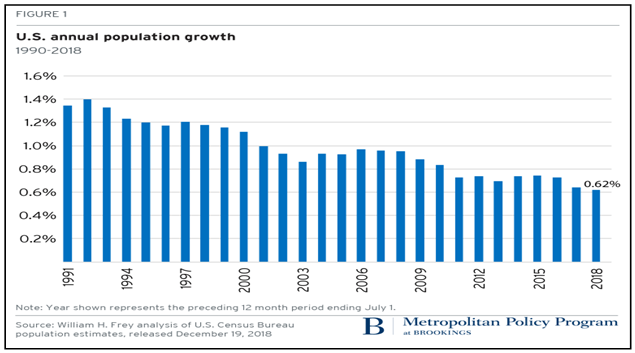

First, we want to look at the rate of population growth. Consider Figure 1.

Even before the Great Recession of 2007-2009, the annual rate of population growth had been on a profound decline. This is to be expected. All societies, as they become richer, show declining rates of population growth. This holds throughout the poorer countries of the world, and it happens in those that are already “rich.” In fact, if we take a historic look at this issue, high birth rates have been a practical social response to poor medical care (high infant mortality) and the lack of an old-age pension system beyond the family. In early times, there were good reasons to have many births since 60%-75% of infants would die. It was economically necessary to produce male offspring because of cultural practices in which girls married “out” of the household, while males stayed close and continued the family line (and business—usually farming).

With a drop in infant mortality, the need for redundant births disappeared. With the spread of organized (publicly funded) old-age protection, the private (family-based) burden of caring for parents gradually gave way. Two strong reasons for high fertility evaporated. Birth rates fell.

Childbirth was once the major cause of female mortality. Much family discord arises over raising children—it is difficult. With approximately 60% of women now in the workforce, and with husbands still resistant to sharing “housework”, families have more income but less patience with the demands of children. Parents increasingly wish to invest more in their children, so it is important to have fewer claimants on limited investment funds. So-called “helicoptering” of children is easier with fewer children to attend to. We see that smaller families are both the result of these changes in economic and social conditions, and the cause of such behaviors we observe. As societies become wealthier—ignoring for the moment the severe inequalities in America and a few other places—birth rates (family size) will fall.

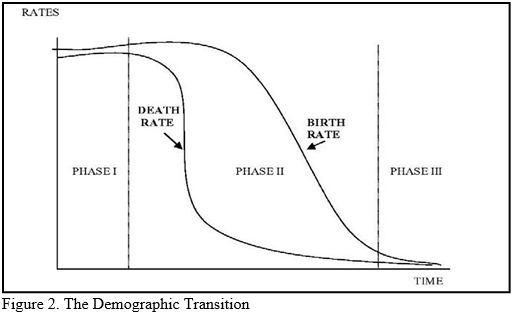

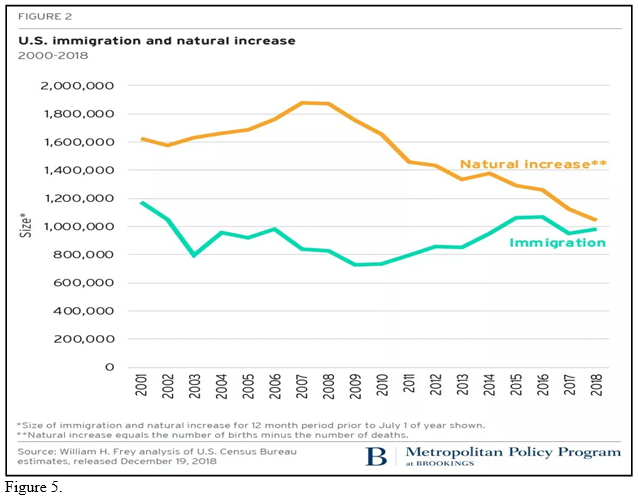

Richer countries also have improved health care, which drives down death rates. We get what is called the “demographic transition—moving from high birth and death rates, through falling deaths because of improved health care, but continuing high births rates from cultural inertia (see above) and finally falling birth rates. The developed world is firmly in Phase III with negative rates of population growth. (Figure 2).

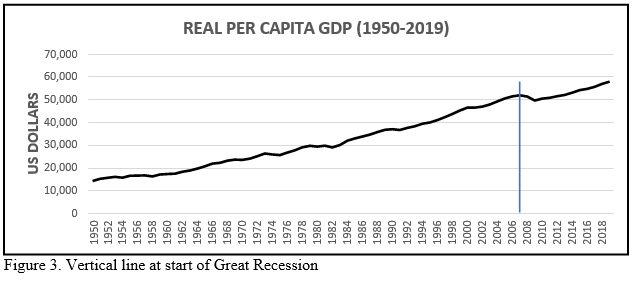

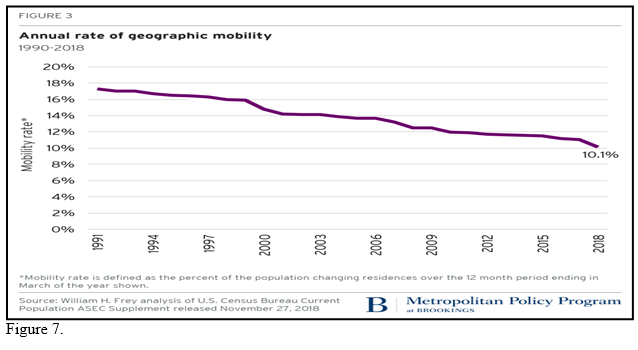

Being a rich country is a symptom of “mature capitalism” –we have “arrived.” It is in the success of the system—making us richer—that we find the seeds of an eventual decline in its ability to do what we want from it. After all, with fewer births, there are fewer energetic youngsters to enter the work force and keep it vibrant and dynamic. The system’s success is the source of its gradual stagnation (Figure 3).

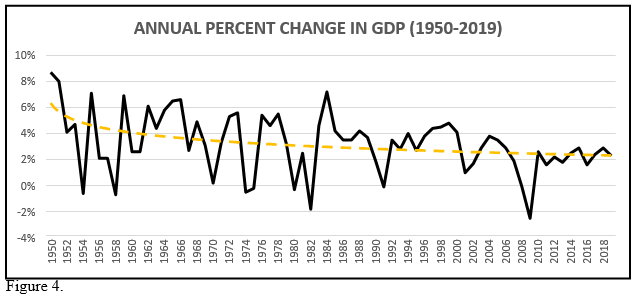

That is why we now see—in Figure 4—low rates of growth in GDP (when compared to the “go- go” post-war years of the 1960s and 1970s). In an analogue of our own human life cycle, aging is a plausible reason to slow down a little. A mature capitalist economy loses its vigor.

Much of the growth of the American economy throughout our history has been the arrival of immigrants. After all, since around 1600, virtually everyone who became an American had arrived in a ship or came north out of “new Spain.” In the period after World War II, immigrants continued to fuel our economic growth. They did the hard and dirty (and impecunious) work that others, newly rich, no longer wished to be bothered with. Immigrants will always drive economic growth—they are eager or they would not have come here, they are relatively poor and dislike their poverty, and they are willing to do most anything to put bread on the table.

In Figure 5 we see an ominous sign for the growth of the U.S. economy. Specifically, immigrants are not replacing the decline in indigenous (“natural”) births. With the current politically inspired hostility toward immigrants, we now face the worst of both worlds—declining “native” birth rates, and disappearing immigrants. Who will do the work?

Now to births. Recall I earlier predicted a quite dramatic drop in births following this health and economic crisis. Consider just such drop in both Figure 1 and Figure 5. Those earlier birth rates are not coming back.

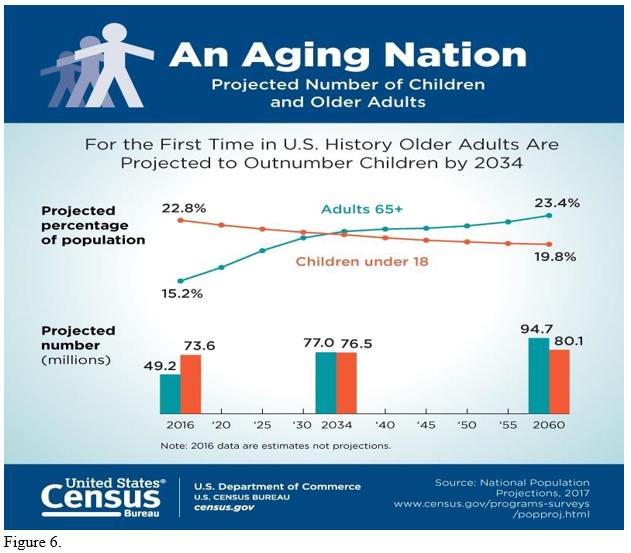

It is also well known that the American population is aging (Figure 6). Aside from the obvious implications for the labor force, there is the challenge of funding the Social Security (and health systems) with a declining share of the population actually working.

Finally, and returning to the nature of the active workforce, a maturing society and economy also shows signs of less mobility. It was once said that the typical American family moved every five years—and those moves were driven by job mobility, new opportunities, etc. But look at Figure 7. Since 1991, the rate of geographic mobility is now almost one-half of what it had been. There are fewer young people to move about, and older folks prefer to stay where they are. When companies close, or lay off employees, those who are somewhat settled, with a family, or who are close to retirement age, will remain in place. That too is a result of our relative wealth and comfort.

These demographic signs must be seen as playing a profound role in the post-COVID economy.

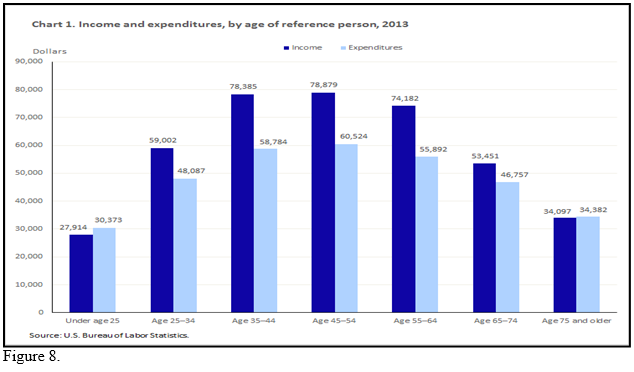

Consider spending by age group. In Figure 8 we see (for 2013) that the age-identified spending varies over the course of a lifetime. Household incomes reveal that after the “reference individual” turns 44 years of age, spending stagnates and then drops. The general retail sector, where much is spent on ever-changing fashion (clothing and sportswear) for the younger set, faces a difficult future. Many of the shuttered retail shops—catering to a precarious demographic—are not coming back. The big-box retailers (Macy’s, Bloomingdale’s), where the older cohort tends to shop, are also in deep trouble. Older people spend less, and they are dying off.

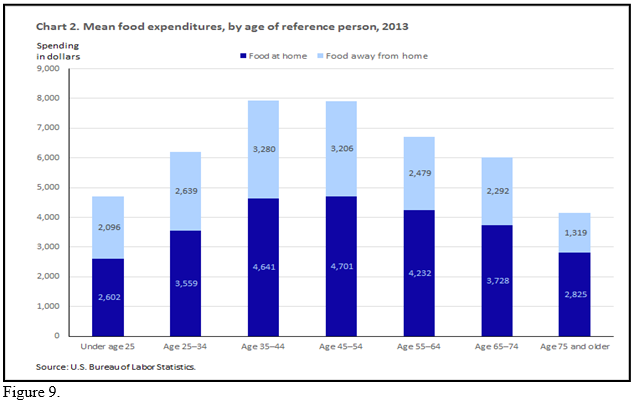

As for the future of restaurants, Figure 9 shows a similar trend for food expenditures, with a particular interest in food away from home. Notice that the restaurant sector is not well served by an aging population. Those of us in Madison know what it is like when the Epic crowd descends on the area’s up-market restaurants around 6:30. With job losses among the younger workers in the service sector, births will disappear as economic uncertainty presses in on them. They will have less money to spend.

In summary, birth rates will now plummet to unheard-of levels. Older workers will find it difficult to re-enter a stressed labor market, and 20-30 year-olds will face a problematic work

prospect the next 5 years. One bright spot seems obvious. With job prospects so grim, many high school graduates will decide that pursuing a college degree seems like a good idea. The opportunity costs are low (no well-paying job to forego), and the post-recovery work place will increasingly be bi-furcated into those with college-based skills and discipline, and the rest. The economic inequality in America may persist.

As an interesting aside, I also notice in the NYT that Uber/Lyft drivers are upset that they cannot get “unemployment” insurance. Sob, sob, sob. Recall how pleased they were to “disrupt” the regular structure of employment (taxi drivers holding actual jobs with taxi companies, or driving their own licensed privately owned cabs)? The average Uber driver worked 10 hours a week, cherry picking and skimming the market during rush hour. Being a disrupter was a badge of honor. Now they wish to be considered “unemployed.” Hmmm.

Dr. Daniel Bromley can be contact at dbromley@wisc.edu.